Paging All Media Buyers: Using a “One Audience” Strategy is the Easy Button You’ve Been Seeking

Data should be used by all teams involved in an advanced TV strategy. The people responsible for consumer analysis, segmentation, media buying, and targeting are likely to agree. If asked, they would swear they use data effectively in execution. But here’s the real difference between organizations that operate as data leaders and everyone else who just talks the talk. In true data savvy organizations, there are multiple teams but a consistent data set.

You have a single strategy, but multiple audiences?

What happens when data starts to divide the marketing process rather than bring it together? Let's walk through a simple TV buying and execution scenario where multiple datasets are in play across the entire campaign lifecycle.

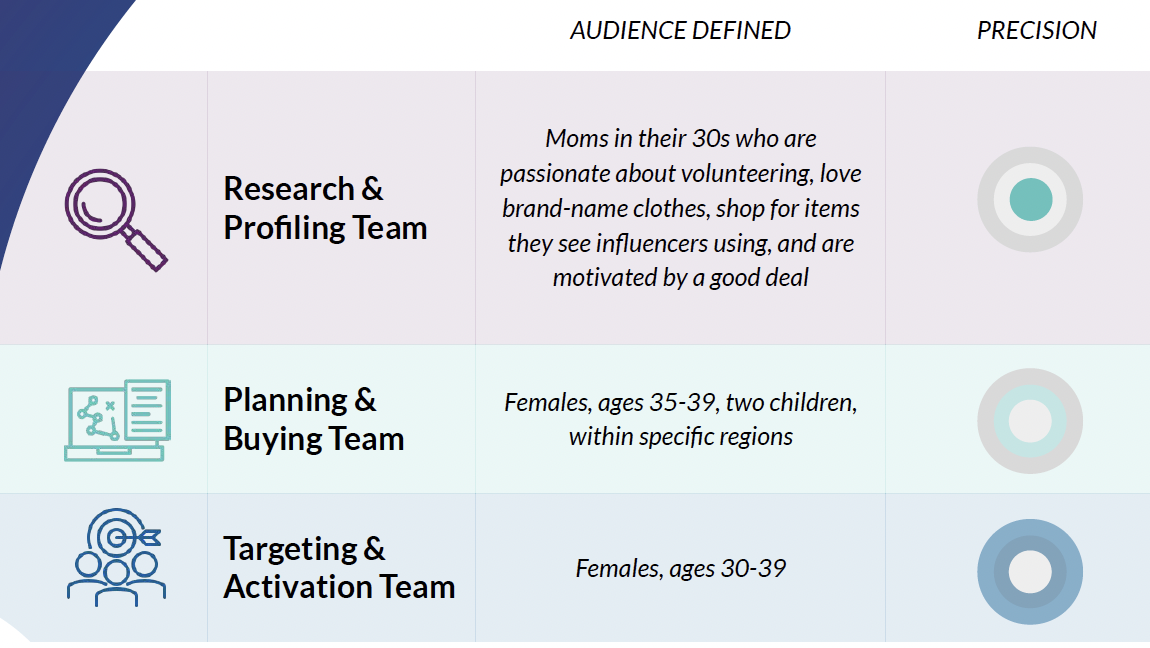

- Step 1 - Research & Profiling: A brand’s research team uses their preferred data set to conduct market research and identify relevant trends. They create in-depth profiles of current and potential customers, as well as those of competitors. The ideal target personas are constructed from a sophisticated combination of variables and the insights are passed to the media team. For example, this could be moms in their 30s who are passionate about volunteering, love brand-name clothes, shop items they see influencers using and are motivated by a good deal. The brand team constructs this target using trusted market research or 1st party data.

- Step 2 - Planning & Buying: Now the media team has a strong picture of who they’re trying to reach, but it’s just that. A picture, not a targeted list. Since the teams are relying on different tools and disconnected datasets, the media team commonly leverages a second data source to try and recreate the target persona defined in Step 1, making some high-level, educated guesses. This leaves them leveraging a proxy audience inside their TV planning tool, one based on much more simplistic variables like females, age 35-39, two children, and specific regions. Ultimately, the team identifies three programs that over-index for the proxy audience they manually recreated. To execute the buys, they coordinate with the network to secure inventory.

- Step 3 - Targeting & Activation: In traditional media buys this then leads to the media owner reserving ad space across the inventory selected by the brand or agency. For targeting in digital, addressable video (or CTV), and/or social networks, marketers that do not own, license or have permission to leverage that same target persona are forced again to choose from whatever data is available in the media environment, creating yet more proxy target personas.

- Step 4 - Measurement: Then of course the marketer wants to understand the performance of their campaign. To do this they are often limited to measuring outcomes against a list of people who were exposed to the ad that can solely be qualified by a simple demo, in this case females in their thirties.

Are you playing a game of “Audience Telephone”?

By the time media has gone live, the target has gone through a daisy chain of potential lost in translation moments. Along the way, you've lost some of your target audience and reached unintended audiences as well. What was once a data-driven strategy has become a guessing game.

The example above is why the industry is racing to create more interoperable data environments, and clean rooms to move data around safely. As viewers fragment their attention, buyers need to chase viewership in more directions than ever before. Buyersare often faced with dozens of platforms to manage, multiplying the possible datasets a target persona needs to be able to move through.

75% of traditional TV households, who subscribe to cable, satellite, or fiber optic TV service, stack at least one streaming service on top of their traditional TV package.

TV ecosystem partnerships are great; fragmented data strategies not so much.

Essentially, the answer to a data fragmentation issue can’t be to select one media destination and call it a day. Partnership cannot be avoided, and instead should be embraced. The tricky part is to keep media fragmentation from turning into audience fragmentation and derailing a strategy altogether.

Many media players are embracing this change, making it simpler than ever to activate using the same data that many agencies rely on for planning. By using the exact audience, even if it’s within dozens of buying platforms, there is greater clarity when measuring impact and reach to drive efficiency.

For example, MRI-Simmons has long been recognized as the leader in syndicated audience research, trusted by nearly every leading agency and the brands they support. For decades now, teams have relied on us to deeply understand their customer, their prospects, their competitors and the overall consumer ecosystem. And now, MRI-Simmons’ audience activation solution, ACT, makes it possible to:

- Clearly define targets

- Fine tune models to balance reach vs accuracy

- Have transparency & control over costs

- Activate audiences across any DMP, DSP, SSP or addressable media destination

Identity is the linchpin in a “one audience” strategy.

Using one dataset end-to-end requires identity. While TV veterans like to complain about how slowly the industry changes, a collaborative approach to identity has made major strides in recent years. For example, The TradeDesk Unified ID 2.0, is designed to enable publishers, data suppliers, and platforms to all resolve to a standard ID so that sharing data and working together can be not only possible, but simple.

Data without the opportunity for action = meaningless

A solid data strategy requires data that is ready for action. Without the ability for action, you’re bound to have a piecemeal approach prone to wasted time, dollars and performance.

So you’re on board with a “one audience” strategy. But which data source should you double down on? Consider these red flags as you evaluate potential market research data sources to support your end-to-end campaign vision.

Potential Data Source Red Flags 🚩

- Insights only - The insights are rich and interesting but cannot be tied to an actual individual or household for activation and analytics. Personas or segments can help identify which media channels to prioritize, but the media destination will need to recreate the segment using alternative data sets.

- Lack of Representation - Is the data representative of the population? Make sure key variables are represented across age, gender, income, ethnicity and more. It is critical to ensure the data you decision from is reflective of the population you are trying to engage.

- Single channel focus - Some data sources are incredibly powerful and even capture in-market individuals based on digital behaviors. However, this data is oftentimes handcuffed to a single channel like digital. The result is only useful for targeting, not advanced research or analytics. This data is also inaccessible for other channels in your strategy like data-driven linear, CTV, social, podcasts and more. A single channel focus is a no-go for a single audience strategy.

- Potential bias - Ensure survey recruitment is not attracting primarily “professional survey takers” which leads to questionable methodology when pulling insights.

“One Audience”: What it looks like in practice.

Let’s return to the same scenario. Only this time, let’s use one audience consistently throughout the campaign workflow.

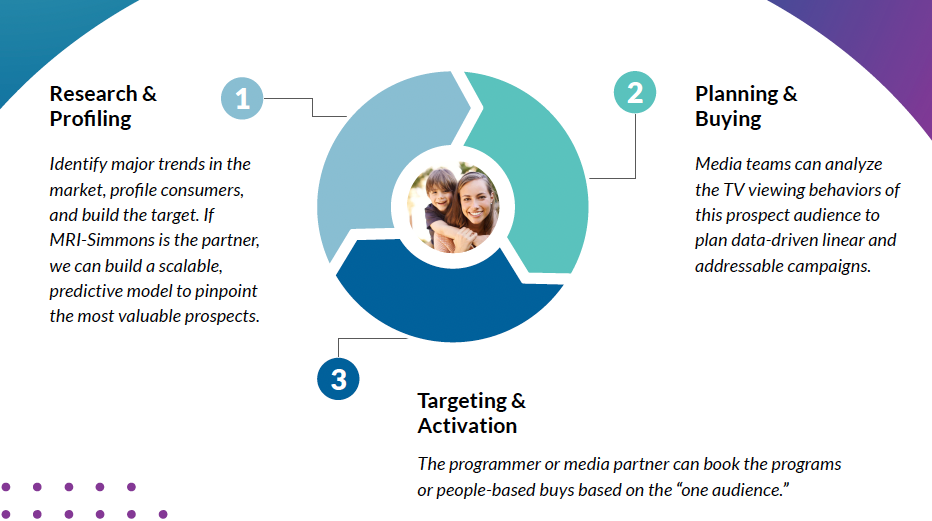

- Step 1 - Research & Profiling: The research team starts by using the dataset to identify major trends in the market, profile consumers and build their target. If the data partner were MRI-Simmons, for example, we would build a scalable, predictive model to pinpoint the most valuable prospects based on the research team’s audience definition. The target audience profiles and the target audience list is now passed to the media team.

- Step 2 - Planning & Buying: Using their TV planning tools, the buying team is able to overlap the exact audience with viewership data to see what they are watching more specifically. They identify three networks that over-index for the audience as part of a data-driven linear strategy. The team also sends the audience to the programmer for a one-to-one addressable CTV ad buy.

- Step 3 - Targeting & Activation: The programmer reserves the ad space across the networks selected by the brand. They also launch the targeted CTV buy to the onboarded audience. The campaign management team can then also leverage the same MRI-Simmons audience for targeting in digital display, social, and mobile ads.

- Step 4 - Measurement: From app downloads, to online sales, to product awareness and beyond, the seller can now support a measurement solution that connects the target audience to the campaign exposures and ultimately back to the outcomes the advertiser experiences.

In this scenario, the media buying process started and ended with a single target audience. As a result, the media buy was more able to more effectively be monitored and the impact of the target audience more clearly understood so the results could yield greater impact.

People-based TV is 100% doable with the right data strategy.

Just because there are market research data sources and strategies you should be wary of doesn’t mean people-based TV is out of reach. The good news is that many companies have grabbed the wheel and demonstrated that data-driven TV planning and buying can work. Data-driven linear, CTV, OTT and digital campaigns are proving that the right data investments deliver big rewards across screens.

Looking for a partner who can deliver the ‘one audience’ you need for an end-to-end advanced TV strategy? Let’s discuss your company’s unique data needs, and how we can make audience fragmentation a thing of the past. By leveraging human-centric data points consistently throughout the buying process, brands and agencies are ready for prime-time (even when they are buying scatter).