Navigating the Storm: Understanding Inflation’s Impact on Consumers

Let’s face it, inflation has impacted many of us in several different ways. Whether it is forcing us to drive less to reduce gas expenditures or avoid taking a much needed vacation, inflation has been hitting millions of people right where it hurts, in the pocket. That made me wonder - as the debate about inflation's impact on the economy continues, are Americans starting to loosen the purse strings and expand their purchase behavior? After doing some digging, I determined that it depends on what activities or behaviors you’re looking at. Let’s take a deeper look.

According to the latest MRI-Simmons 2Q24 Trending Topics study, 33% of adults 18+ are cutting back on travel, down from 39% just a year ago. When it comes to driving, 36% of adults are curbing their driving in order to save on gas, down from 41% at this time last year. In fact, the issue of saving on gas is affecting the types of vehicles people are planning to buy. Since last year, there’s been a 42% increase of Americans 18+ who are considering purchasing a vehicle that’s more fuel-efficient.

In terms of entertainment activities and going out to eat, 47% of adults say they are cutting back on eating out, but that is down 11% from last year. As for attending sport games or concerts, there is more good news. One in three adults (33%) are cutting back on attending events, down from 36% last year.

Some areas that have been hit harder due to inflation involve credit card usage, exercise, and subscribing to TV streaming services. 18% of adults say they’re using their credit card more or buying on credit, which is an 11% increase from a year ago. Coincidentally, there’s been a 41% increase in adults who have either switched or applied for a new credit card. When it comes to belonging to a gym, there was a 24% increase among people canceling their membership compared to last year. Even TV streaming services are taking a slight hit, with 26% of adults reducing their services compared to 24% from a year ago. As inflation stabilizes, and consumer's financial confidence improves, it is a prime opportunity for marketers to attract new customers and increase market share.

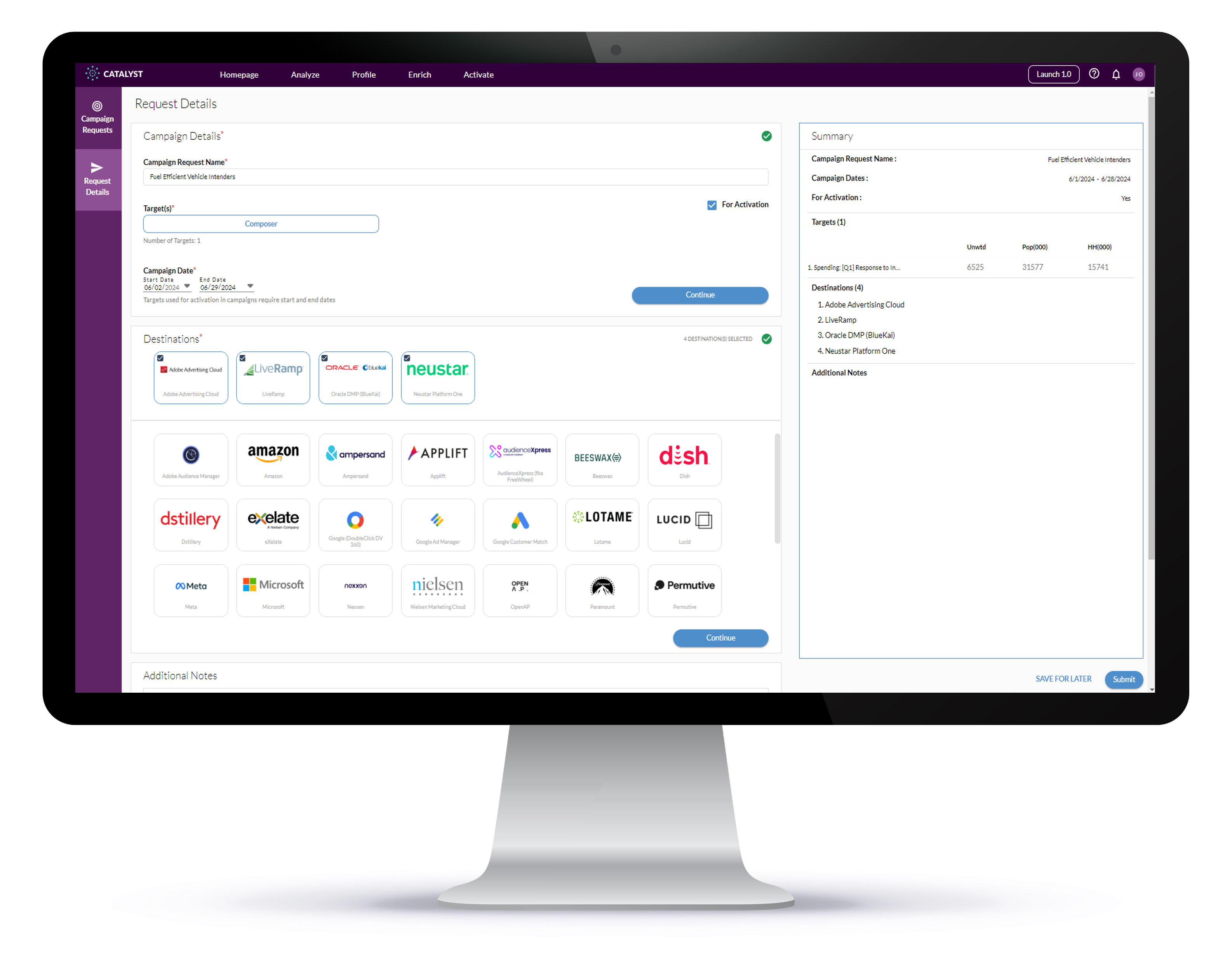

Activating Inflation-Challenged Consumers

With 31.6 million consumers thinking about investing in a more fuel-efficient vehicle and 93.6 million cutting back on driving because of the high cost of fuel, marketers can target either (or both) of these segments with imagery and messaging that resonates with their inflationary challenges.

Through MRI-Simmons' activation solution, ACT, marketers can leverage trusted and nationally representative data to target and reach this cost- and eco-conscious consumer target. Curate your audience with over 60K consumer elements: 1000+ attitudes and opinions, 6500+ brands in 1000+ product categories; and 90+ proprietary segments. Then, activate via the DMP, DSP, SSP, MVPD, or programmer of your choice.

Want to learn more about attitudes and behaviors around inflation or other current affairs? MRI-Simmons quarterly Trending Topics Study provides some of the most accurate data available on how American consumers feel about key “in the news” topics, what’s important to them when they vote, and how to reach them.

Contact us today to learn more.

Source: MRI-Simmons 2Q24 Trending Topics Study. Base: A18+.