Activating the Black Friday Frenzy and Engaging Shoppers Primed to Splurge

According to MRI-Simmons’ Retail Trends Study, 29% of Americans, translating to over 74 million adults, are gearing up to tackle most of their holiday shopping between Black Friday and Cyber Monday this year. These savvy shoppers are 30% more inclined than non-Black Friday shoppers to have mostly shopped in physical stores over the past year; however, this season, 28% are planning to ramp up their online shopping. Last year, they splurged an average of $890 on Winter holiday purchases, so advertisers should tap into this audience with content they can relate to and that’s relevant to their lifestyles and goals.

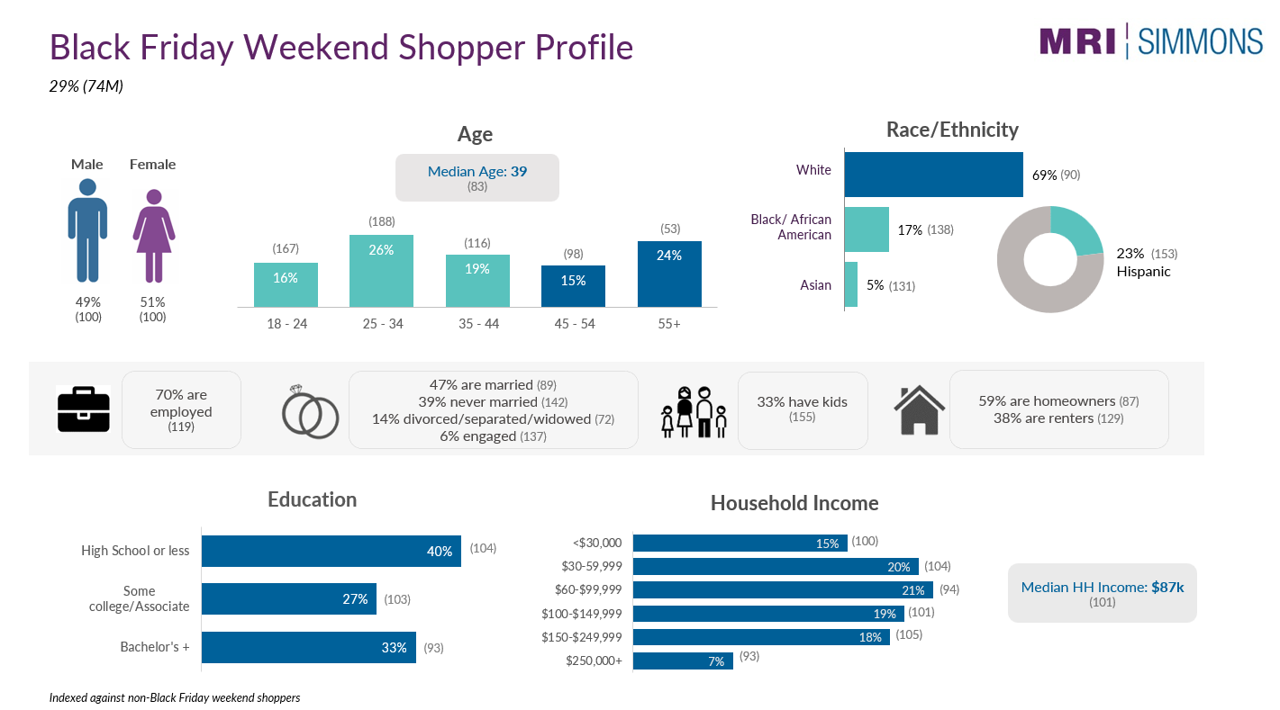

Who are this year’s Black Friday weekend shoppers?

Americans who plan to shop during Black Friday weekend are a diverse group, but they skew younger with a median age of 39 years old. Specifically, Gen Z are 107% more likely than the average American to plan to do most of their holiday shopping on Cyber Monday, while Millennials are 37% more likely to plan to shop on Black Friday. Ads and in-store promotions need to connect with a younger audience for the greatest impact. Black Friday weekend shoppers are 38% more likely to be Black and 53% more likely to be Hispanic than non-Black Friday shoppers, indicating demographically diverse content will be important for connecting with this group. Additionally, these shoppers are 42% more likely to be single, and 33% of them are parents with kids.

What interests them?

Black Friday weekend shoppers have a variety of interests that can be leveraged in advertising campaigns. They are 65% more likely than non-Black Friday shoppers to have played soccer in the past year and 52% more likely to have played basketball, suggesting they would relate more closely to content that involves sports or fitness. Additionally, they are 58% more likely to have attended a hip-hop or rap concert and 29% more likely to have attended a music festival in the past year, showing a strong inclination towards music or live events. Their interest in portable video games and fantasy sports, being 38% and 33% more likely respectively, highlights their engagement with interactive and competitive activities. These interests provide multiple touchpoints for advertisers to connect with this audience through relevant content and experiences.

To stay competitive, advertisers can create interactive shopping experiences like virtual reality (VR) or augmented reality (AR) shopping. Allowing customers to virtually try on products or see how items look in their homes can initiate a memorable and engaging “gamified” shopping experience.

What do they value?

Black Friday weekend shoppers place a high value on social status and lifestyle. They are 47% more likely than non-Black Friday shoppers to value having a high social status and 35% more likely to want a lifestyle that impresses others. Fashion is important to them, being 32% more likely to want to be seen as fashionable. Career aspirations are also significant, with 46% wanting to make it to the top of their profession (index 126). Messaging that focuses on a product’s luxury or ability to elevate social standing could be effective with these shoppers.

From a cultural standpoint, Black Friday shoppers are 36% more likely to feel good about seeing celebrities in the media that share their ethnic background and 26% more likely to feel connected to their ethnic heritage than their parents. These values can guide advertisers in crafting messages that resonate with this audience’s aspirations and cultural connections; also, ads should reflect the cultural and racial diversity of their target shoppers.

In addition to valuing their ethnic culture, Black Friday shoppers have a “save the planet” mindset. They are 22% more likely than non-Black Friday shoppers to choose methods of transportation that are friendlier to the environment and are 19% more likely to want to be seen as environmentally conscious, so highlighting any sustainable or eco-friendly products you offer would be an effective ad strategy. Promote initiatives like donating a portion of Black Friday sales to environmental causes or offering discounts for customers who bring in recyclable materials; this would speak to the values of Black Friday shoppers.

For fun, these shoppers are also 32% more likely to love keeping up with celebrity gossip and 30% more likely to enjoy outrageous situations, so messaging and experiences that shock or test the boundaries of what can be in ads could make an impact.

How do they shop?

Understanding the shopping behavior of Black Friday weekend shoppers is crucial for effective advertising. A significant 84% of them are more selective about what they buy now as they aim to save money. Online shopping is particularly appealing to them, with 83% preferring it for the ease of finding specialty products and services. Offering exclusive Black Friday deals online can attract this audience, and highlighting deals through email marketing, targeted online ads, and social media posts can drive traffic to your website. Social media can be extra effective with these shoppers because 64% often click on video ads when they see a product they’re interested in. Creating compelling video content can drive engagement. Showcase your best deals, product demonstrations, and customer testimonials through short, impactful videos on platforms like TikTok and Instagram. Brands could even run social media contests where customers share their Black Friday or Cyber Monday finds to win a prize, which can increase engagement and brand visibility.

These shoppers are diligent researchers, with 81% liking to shop around before making a purchase and 76% spending more time researching brands than ever before. Saving money is the number one priority for 73% of these shoppers, and 72% find online shopping helps them stick to a budget. Given money is top of mind, advertisers should emphasize savings and discounts. Using bold, attention-grabbing headlines and visuals to highlight the percentage off or dollar amount saved could be an effective strategy this year.

Since 65% of Black Friday shoppers go out of their way to find new and unique brands, emphasizing any specialty or exclusive products you offer can differentiate your brand from competitors and attract shoppers looking for something different. Related to brands, 55% of Black Friday shoppers often do online research to see how a brand has reacted to various social issues, and they are 56% more likely than non-Black Friday shoppers to be influenced to buy a brand by a social media influencer. Partnering with influencers who align with your brand to highlight your Black Friday deals would make an impact with Black Friday shoppers by amplifying your message with their authentic endorsements.

Where can they be reached?

To effectively target Black Friday weekend shoppers, advertisers need to know where to reach them. When watching TV in the past 30 days, they’re clicking on TeenNick (index 171 compared to non-Black Friday shoppers), MTV2 (161), and Disney XD (160). Streaming services are another important channel, with higher likelihoods of using Apple Music (129), Spotify (128), Disney+ (127), Max (120), and Hulu (119) in the past month. Regarding social media over the past 30 days, Black Friday weekend shoppers are 43% more likely to have used Snapchat, 31% more likely to have used TikTok, and 25% more likely to have used Instagram. By focusing on these media channels, advertisers can effectively engage with this audience.

By understanding who plans to complete their holiday shopping over Black Friday weekend, what speaks to them, how they make purchase decisions, and where they get their content, advertisers can create targeted campaigns that effectively engage this lucrative audience and maximize holiday sales.

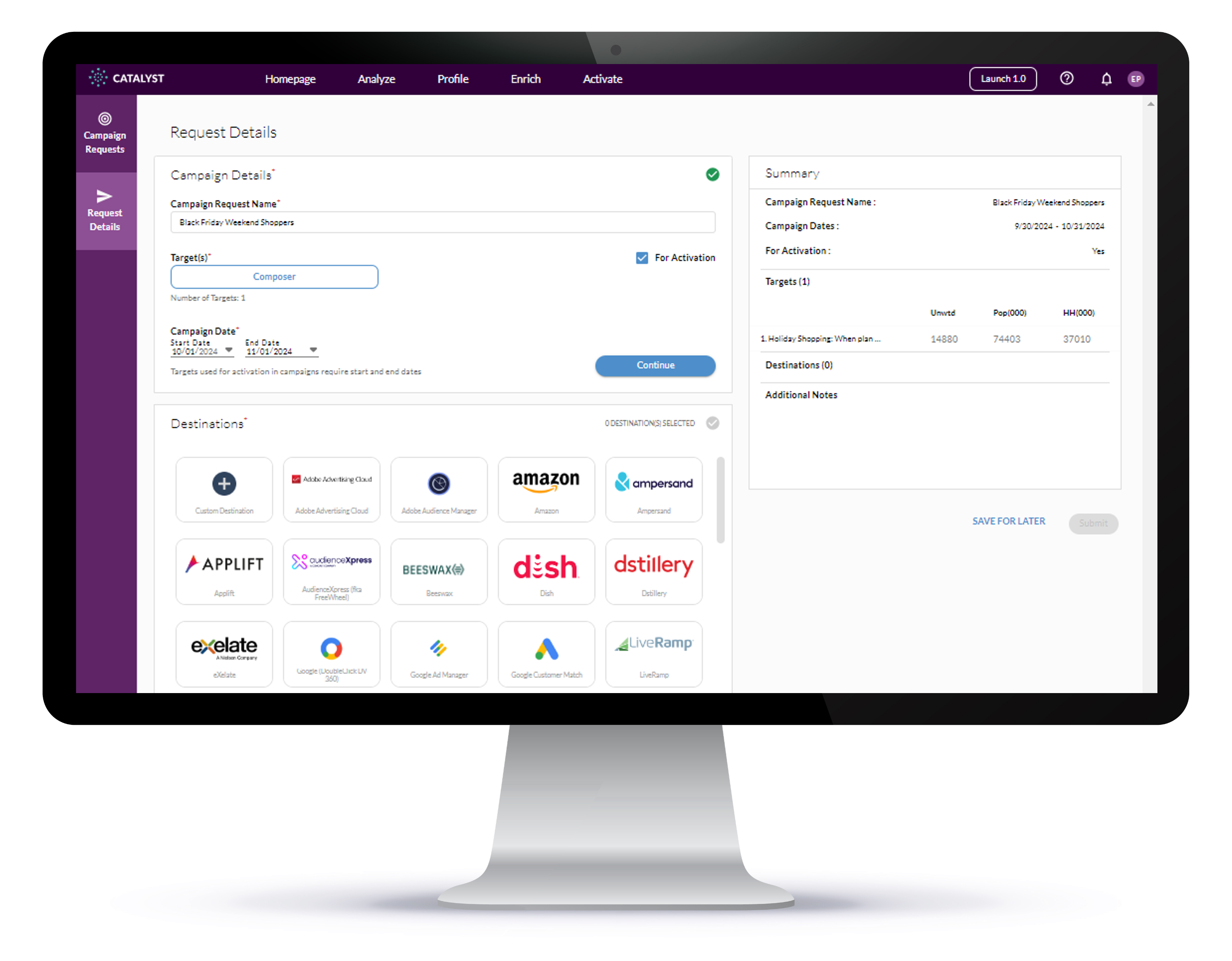

Through MRI-Simmons' activation solution, ACT, marketers can leverage trusted and nationally representative data to target and reach Americans planning to shop this Black Friday weekend. Curate your audience with over 60,000 consumer elements: 1000+ attitudes and opinions, 6500+ brands in 1000+ product categories; and 90+ proprietary segments. Then, activate your audiences via the DMP, DSP, SSP, MVPD, or programmer of your choice.

Want to learn more about American shopping trends? MRI-Simmons’ Retail Trends Study provides a clear line of sight into the motivations and lifestyle factors that drive channel preference to help reach today’s shoppers more effectively and efficiently.

Contact us today to learn more.

Source: 2024 August Retail Trends Study (SP24 USA).