Leveraging Co-Viewing TV Habits for Effective Advertising

In today's digital age, television remains a cornerstone of American entertainment, with a significant portion of the population engaging in co-viewing. According to MRI-Simmons’ latest Cord Evolution Study, 78% of American adults, equating to 202 million people, watch video content with others. This shared activity is not just about entertainment; it’s a social glue. 57% of these viewers co-view to spend more time together, while 49% do it because they share the same taste in shows with others in their lives. For advertisers, understanding the dynamics of co-viewing is crucial as it represents a unique opportunity to reach engaged and connected audiences.

Co-viewing is particularly important for advertisers because it amplifies the impact of the content and ads. When people watch TV together, they are more likely to discuss the content and advertisements, leading to higher recall and engagement. Nearly 50% of co-viewers watch with their spouse or partner daily, with the top video types being movies, comedy TV, and action-adventure TV. Furthermore, 57% watch TV content with their friends, primarily enjoying sports, movies, and sci-fi fantasy TV. Not surprisingly, among the 53% who co-view with children 17 or younger, children's TV, movies, and game shows are the top types of video content. These viewing patterns provide advertisers with a clear understanding of the “who” and “what” resonates most with American co-viewers.

The viewing habits of co-viewers also provide valuable insights for advertisers. While 22% choose to co-view on traditional cable or satellite TV, over 50% are most often streaming content together through a subscription streaming service, making digital platforms an essential part of any advertising strategy. The top platforms used by co-viewers are Netflix (59%), YouTube (52%), and Prime Video (47%). Additionally, co-viewers are more likely to stream on ad-supported niche platforms like Food Network Kitchen (Index to US adults: 117), DisneyNOW (115), and Snapchat app (114). This indicates a preference for diverse and specialized content, which can be leveraged by advertisers to create targeted campaigns that resonate with specific interests and demographics.

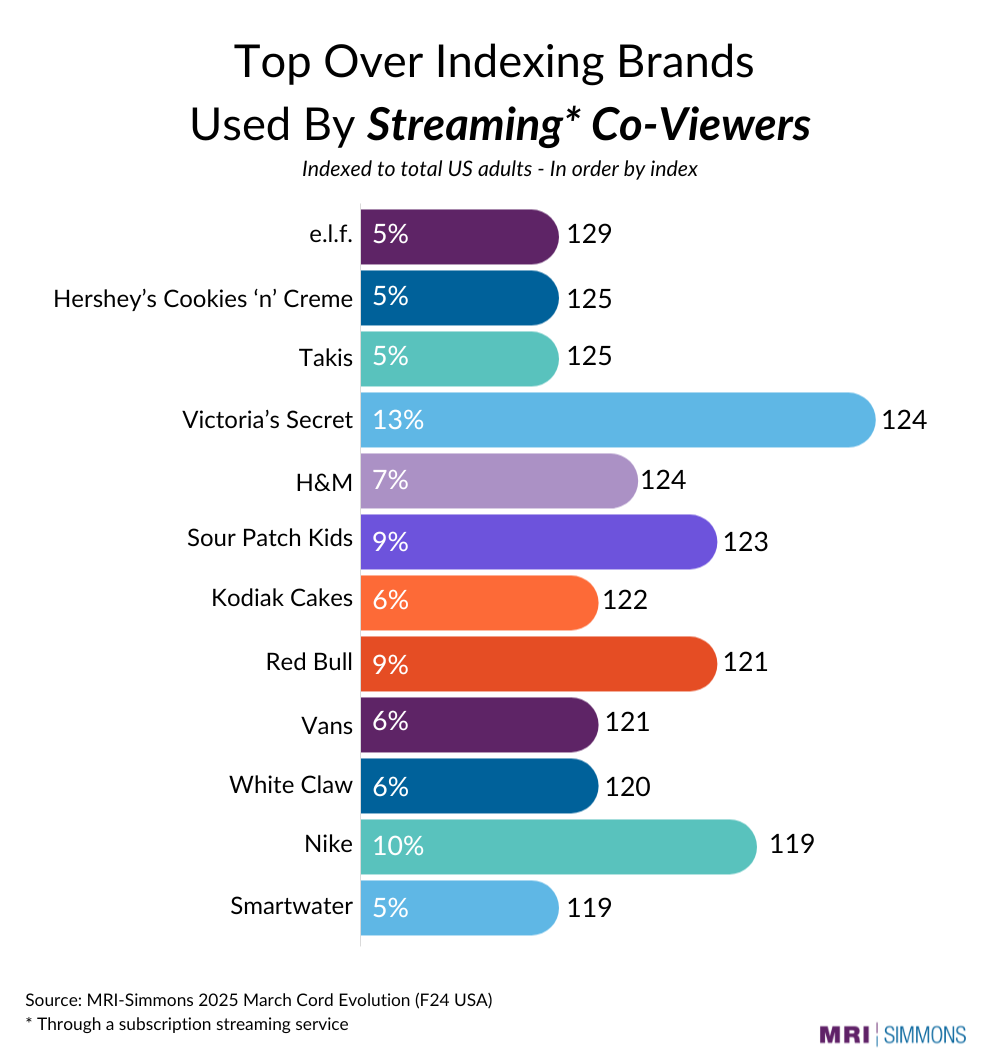

Why should advertisers care? Co-viewers, especially those who stream together, exhibit higher purchasing tendencies across various brands compared to the average American adult. Streaming co-viewers are 29% more likely to buy e.l.f. eye liner or eyebrow pencils, 25% more likely to purchase Takis snacks and Hershey's Cookies 'n' Creme bars, and 24% more likely to buy Victoria's Secret and H&M women's clothing. This propensity to over-index on certain brands highlights the potential for advertisers to tap into this engaged audience with tailored messages that drive conversions. Imagine the possibilities: a cooking show on Food Network Kitchen followed by an ad for Kodiak Cakes waffle mix, perfectly timed to catch the attention of engaged viewers. Or a group of friends pulling an all-nighter bingeing their favorite new show and then seeing an ad for Red Bull or White Claw—it's a perfect match!

Co-viewers represent a strong target for activation due to their engaged and connected viewing habits. Shared experiences like watching TV together not only enhance the enjoyment of the content but also amplify the impact of advertisement. By understanding and leveraging the unique characteristics of co-viewers, advertisers can create more effective campaigns that resonate with this valuable audience, ultimately driving higher engagement and better ROI.

Sources: 2025 March Cord Evolution (F24 USA), 2024 Content Drivers (SP24 USA)

Activating co-viewers through MRI-Simmons

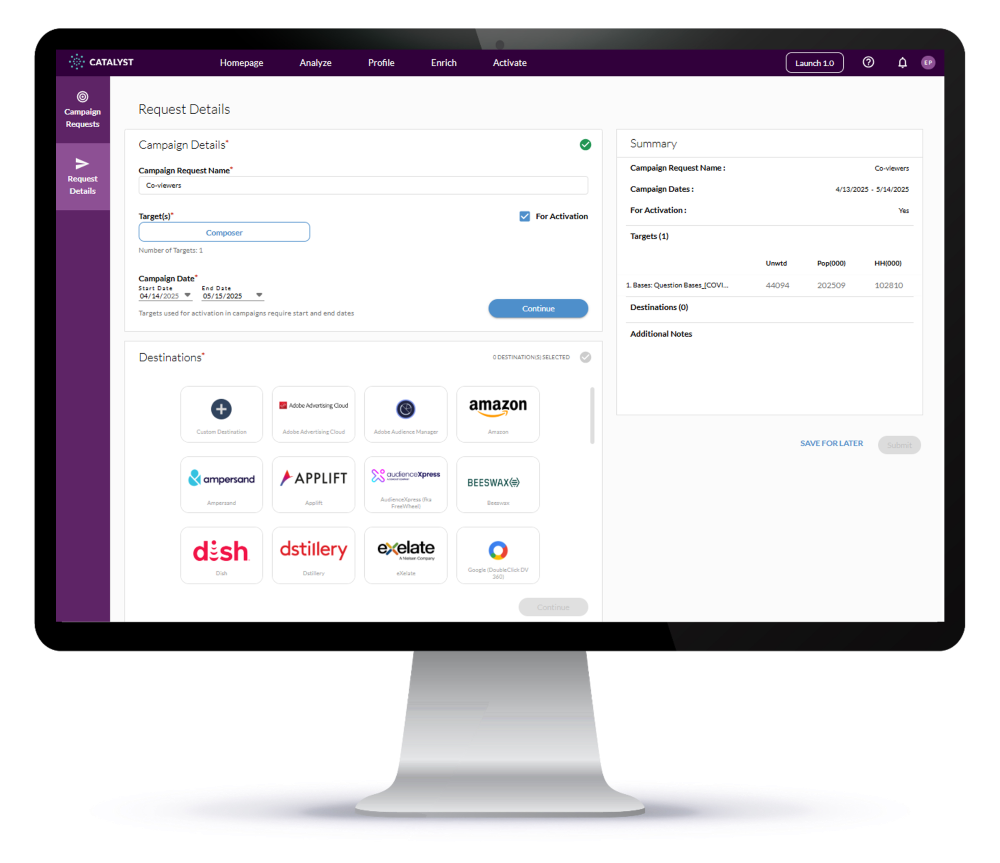

Through MRI-Simmons' activation solution, ACT, marketers can leverage trusted and nationally representative data to target and reach American co-viewers. Curate your audience with over 60,000 consumer elements: 1000+ attitudes and opinions, 6500+ brands in 1000+ product categories; and 90+ proprietary segments. Then, activate your audiences via the DMP, DSP, SSP, MVPD, or programmer of your choice.

To learn more about what's included in the Cord Evolution Study or how to measure your streaming service, click here or email info.ms@mrisimmons.com.